Dear Clients and Friends,

Here are my latest thoughts on the markets for your review:

The 2018 outlook will be complex; it will require thoughtful acumen and a global perspective.

As we enter the new year, I am positive on the Global Equity Markets amid strong economic growth and little evidence of a downturn, as a recession still seems to be 1-2 years out.

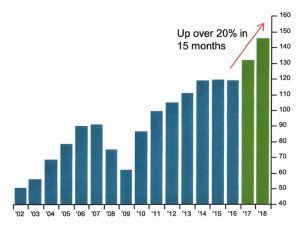

US Equities: A lower corporate tax rate, repatriated foreign cash, and likely share buybacks could further fuel a rise in profits, which will provide opportunities for higher returns in 2018. The S&P 500 could see EPS growth of 12% to $151/share, or 2,870.

International Equities: In spite of political uncertainty, I am positive on International and Emerging Markets. These should be an integral part of equity

allocations.

Bonds: As we enter 2018, we will see higher volatility and bond yields, as monetary policy tightens. Bond yields (10-year Treasury) could rise to 2.8% – 3% due to

higher GDP and inflation.

Oil & Commodities: I expect oil prices to move sideways and stay in a range of $55 to $65/bbl. Inventories are running 10% above normal levels and should provide a

cushion if supplies fall. Commodities seem to be bottoming out as firm demand growth should provide higher prices into the future. A weaker USD and renewed inflation pressure should act as a tailwind moving forward.

Risks: Political events and policy uncertainty pose a threat to investors in 2018, as financial markets will experience greater turbulence and corrections. A likely shift towards tighter global monetary policy will boost market volatility. It is likely that there will be a market correction which may happen early on, or could possibly unfold over the summer, but it would be advantageous to use any correction as a buying opportunity.

As always, please feel free to contact me should you have any questions.

Have a happy and healthy holiday!

Sincerely,

John Kittaneh

CEO|CIO

Telephone: 201.857.8633

Cell: 201.310.1821

Email: [email protected]

54 Oak Street, Ridgewood, NJ 07450