2021 Market Outlook

Continued broad based recovery…

As we enter the final stretch in the 1st quarter of 2021, a sharp rise in Treasury yields has interrupted the equity rally.

Anxiety over rising yields is what is largely responsible for the retreat in stocks.

The rise in yields is due to optimism over growth, not inflation woes. This should not pose a threat to risk assets.

We continue to be in a early-mid cycle stage, where stocks tend to be very strong. Furthermore, equity returns are quite robust in a rising rate environment.

SO THIS RISE IN VOLATILITY…

The rise in volatility is causing the pullback, rather than a fundamental shift in the market outlook. A number of factors should drive this market higher.

-Positive news on stimulus

-Strides in progress against COVID-19 with development of vaccines and partnerships between pharmaceuticals

-Robust manufacturing data

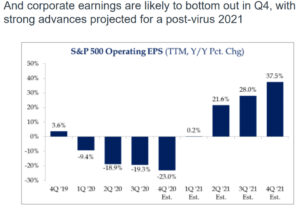

-Strong earnings momentum continuing

-Recovery in China, which has displayed resiliency

I remain confident that the equity rally can resume and expect this pullback to be temporary. I believe that we should use these volatility spikes to add to positions.

As always, please feel free to contact me should you have any questions or concerns. Check out our new website that recently launched! You can find all past and future market commentary on our new site as well.

Stay healthy and well.

Sincerely,

John Kittaneh

Founder & Chief Executive Officer

[email protected]

201.857.8633 | 201.310.1821

54 Oak Street, Ridgewood, NJ 07450

www.capitaleinvestments.com

March 5, 2021