Dear Clients and Friends,

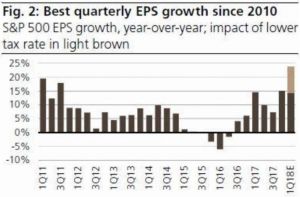

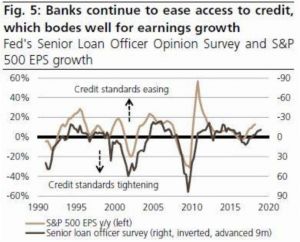

Here are my latest thoughts on the markets for your review: Despite robust corporate profits and growth, market volatility has increased this year while stocks have been range bound year to date. I expect strong earnings growth to continue into 2019, as economic growth still appears to be on solid footing.

Other supporting factors:

- Positive forward looking revenue revisions

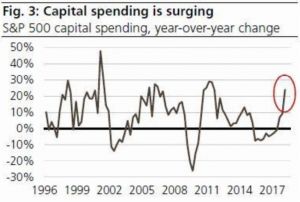

- Raising capital spending and share buybacks

- Robust sales growth

- Operating margin expansion

- Net profits surge to new highs

- Strong earnings growth is key support for US stocks

- Stocks look more attractively valued vs bonds

- Historically when interest rates rise from low levels, equity markets usually perform well

There are some pockets of cost pressures, notably from commodities and wages. Aggregate costs are not rising as fast as revenues and investors remain concerned about negative effects from trade, higher interest rates and rising inflation. In my view there headwinds will dissipate in the coming months.

Therefore I am raising my 2019 SP500 EPS estimates to $170 and my price target to 2975.

As always, please feel free to contact me should you have any questions.

Sincerely,

John Kittaneh

CEO|CIO

Telephone: 201.857.8633

Cell: 201.310.1821

Email: john@capitaleinvestments.com

54 Oak Street, Ridgewood, NJ 07450